The Houston group market relies heavily on the oil and gas industry, particularly business from associated groups headquartered in the local/Southwest regions. In light of the oil industry downturn that plagued 2016, a year-over-year look at actualized group business in Houston reveals its impact on group trends and sheds light on industry segments and subsets that could prove more profitable for meetings and events.

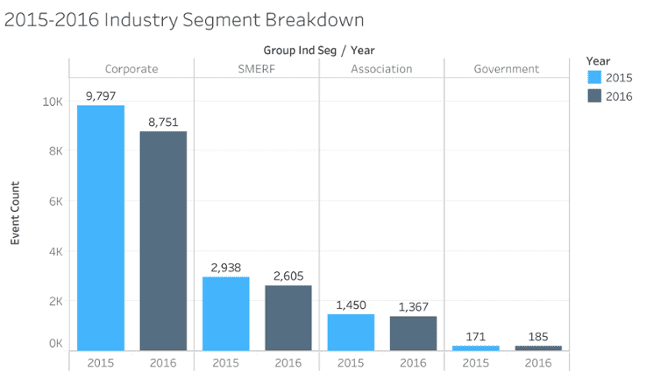

Based on Knowland’s records of meetings that actualized in the Houston market, corporate group business that met in Houston fell 11% YOY (2015-2016). Other industry segments remained relatively stable, with government performing strongest.

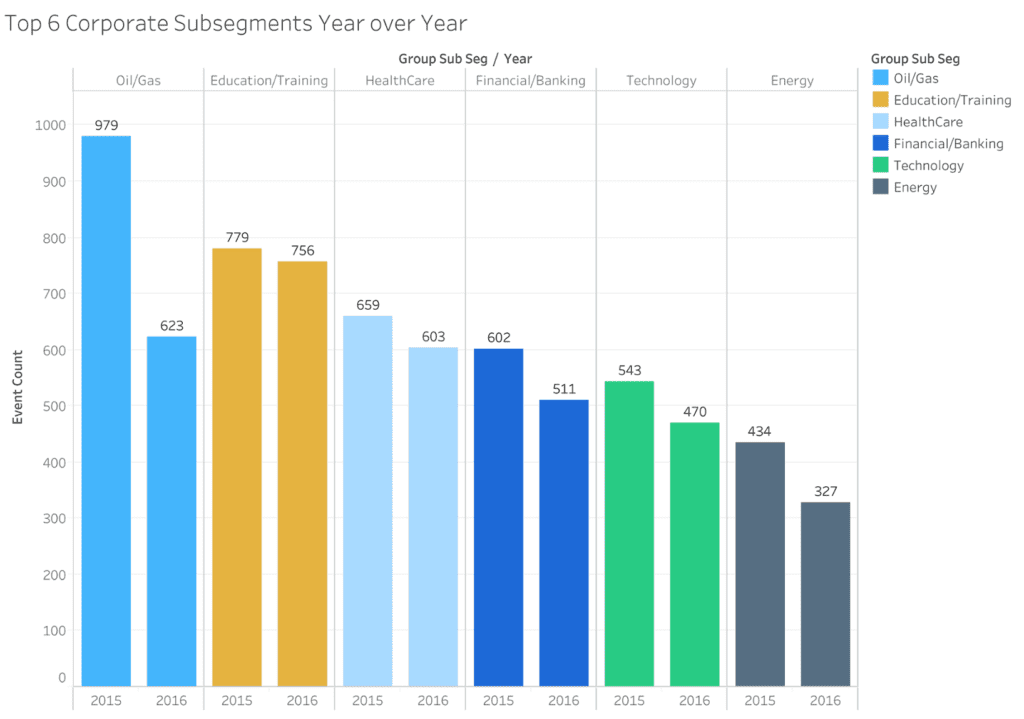

The top 6 corporate subsets holding the most meetings in events in Houston in 2015 and 2016 were Oil/Gas, Education/Training, Heath Care, Financial/Banking, Technology, and Energy. Actualized events in the Oil/Gas subset fell 36% YOY in Houston.

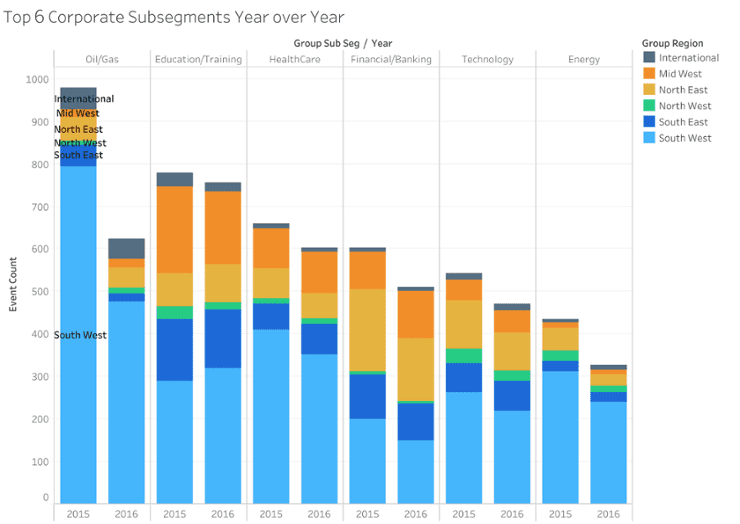

When the performance of the top 6 corporate subsets is [broken out] by group region of origin, heavy reliance on group business from local markets is a clear trend in Houston. Overall, however, regional group business (which accounts for 50% of Houston’s total actualized meetings and events) saw the most significant drop YOY. The top performing subsets YOY by region include:

- Health Care groups from the Southeast and Midwest

- Education/Training groups from the Northeast

- Technology groups from the Midwest, Southeast, and international markets

- Financial/Banking groups from the Midwest

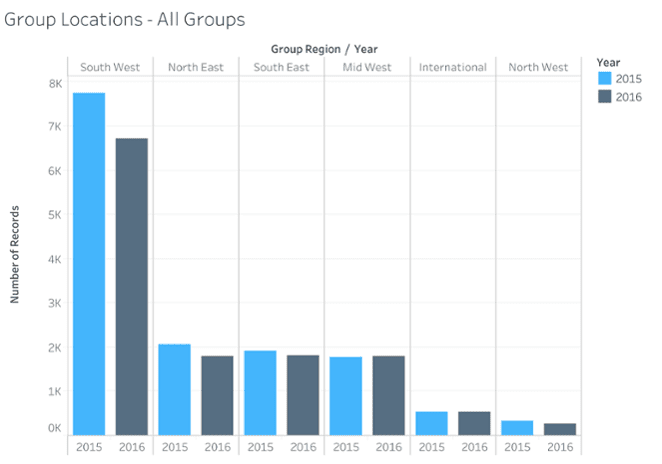

Group business from the Southwest accounted for 50% of Houston’s total actualized meetings and events YOY, heavily outweighing group business from other national and global markets. Meetings in Houston of groups from local regions fell 14% from 2015 to 2016.

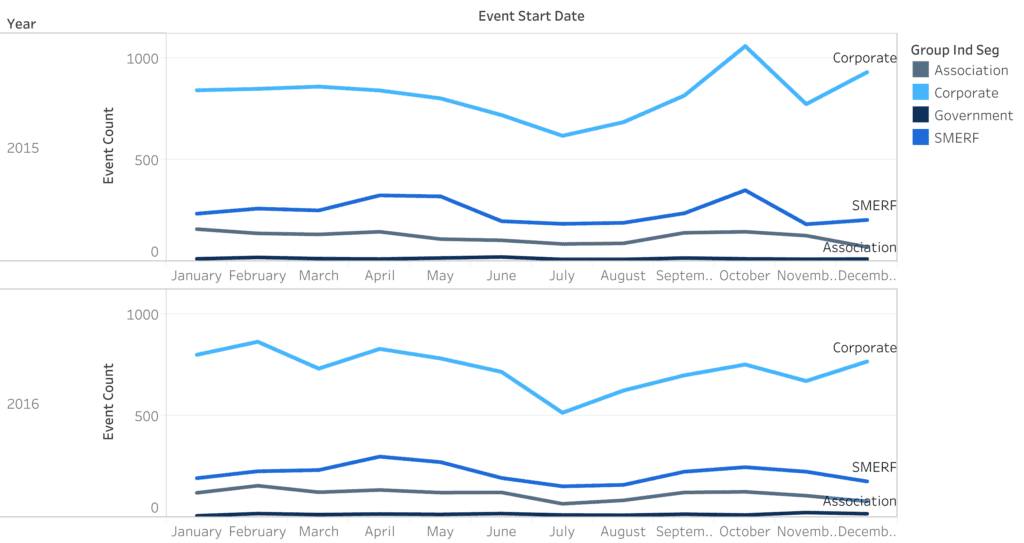

The first half of 2016 was characterized by more volatile month-over-month drops in corporate events compared to H1 2015. Mainly as a result of over-dependence on group business from the oil industry, corporate events fell more than 50% from January to July 2016. Events that actualized in Houston in H2 2016 showed weak overall growth, in contrast to the spike in event counts observed in the back half of 2015.

As local competitors increase, successful hotels need to be more strategic about how they fill their rooms. Staying ahead of other properties vying for group business requires knowing where to look for unique opportunities and what groups are generating the most opportunity. Big data can lend a big hand.

![]()