Smaller cities are benefitting from new group business as meeting planners look for cost savings and personalization that larger destinations do not offer. From 2015 to 2016, Kansas City experienced a slight drop in total number of meetings, but new groups to the market had a strong showing, suggesting there are a number of groups nationwide that would consider Kansas City as a potential destination if presented the opportunity.

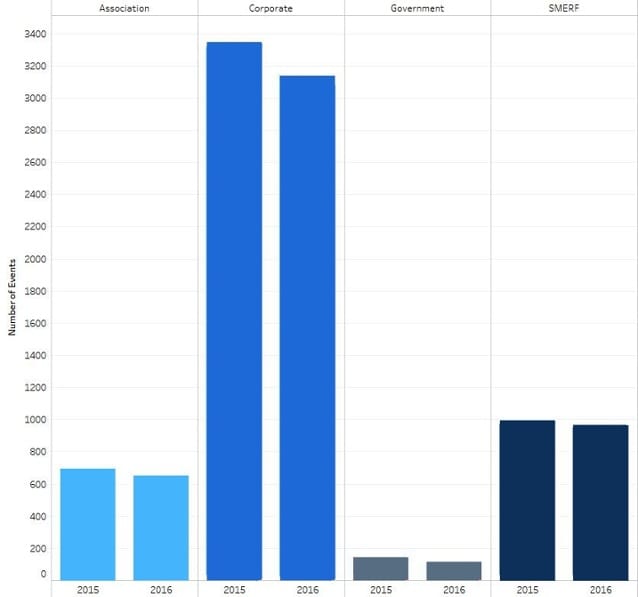

Though the total number of actualized events in Kansas City dipped from 2015 to 2016, the market’s overall performance was relatively stable. Corporate meetings heavily dominate the market, accounting for 64% of group business in the past 2 years.

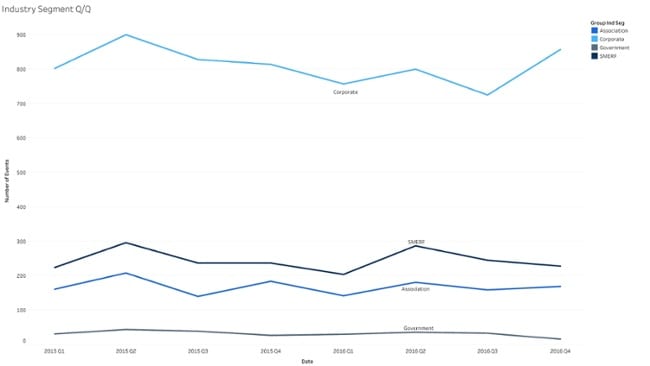

Corporate meetings steadily decreased from Q2 2015 to Q3 2016. The worst performing quarter for number of corporate events was Q3 2016, though Kansas City pulled in a strong number of corporate events at the end of the year.

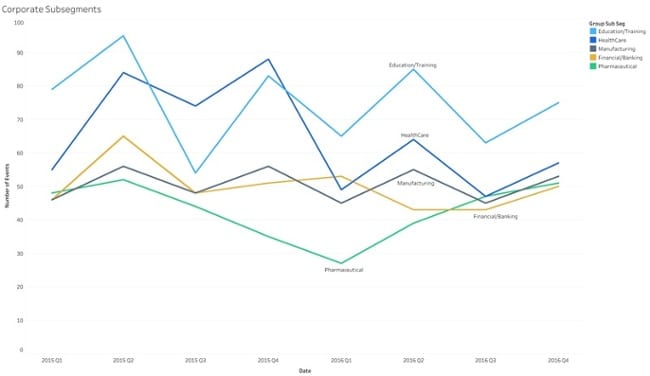

The top 5 corporate subsets holding meetings in Kansas City in 2015 and 2016 were Education/Training, Heath Care, Manufacturing, Financial/Banking, and Pharmaceutical. Pharma meetings fell from Q2 2015 to Q1 2016, but made a strong return by the end of 2016. Financial/Banking meetings in Kansas City were the steadiest quarter over quarter.

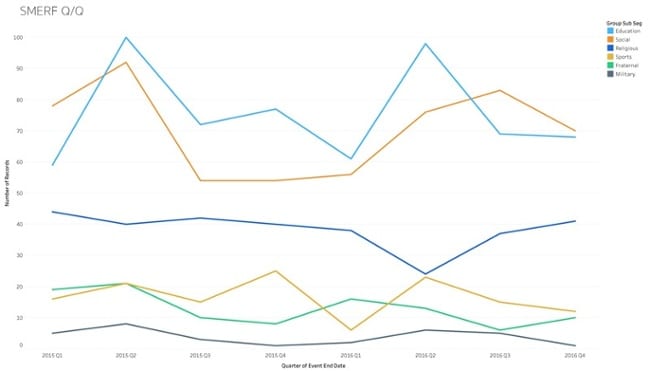

Overall, total SMERF and social events were stable in 2015 and 2016. Within this market segment, Education and Social events occurred most frequently. Both of these subsets, however, saw a strong decrease in number of events between Q2 2015 and Q1 2016. Except for a 40% event count fall and rise between Q1 and Q2 2016, Religious events remained more or less stable.

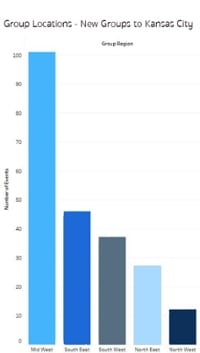

6% of the groups that met in Kansas City in 2016 met in the market for the first time, according to Knowland records. 45% of those groups came from other Midwest markets. 21% came from organizations in the Southeast.

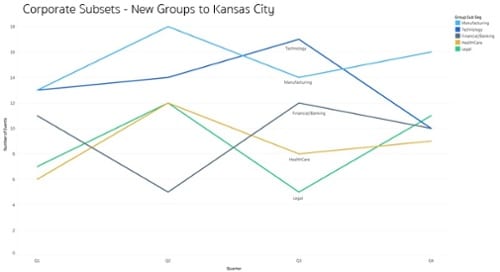

Within the corporate segment, Knowland saw the following trends in the top 5 subsets for new meetings in the Kansas City market:

- Manufacturing meetings dominated actualized new group activity

- Manufacturing, Health Care, and Legal meetings saw a strong uptick from Q1 to Q2

- Financial/Banking meetings were strongest from Q2 to Q3

- Legal meetings increased more strongly than other subsets from Q3 to Q4

- Technology meetings plummeted from Q3 to Q4

As local competitors increase, successful hotels need to be more strategic about how they fill their rooms. Staying ahead of other properties vying for group business requires knowing where to look for unique opportunities and what groups are generating the most opportunity. Big data can lend a big hand.

![]()