London hotels are predicted to see mild growth over 2017, despite an active construction pipeline that will continue to feed thousands of new rooms into the market. With plenty of space to fill and a weak pound encouraging travel, London is uniquely positioned to pursue new MICE sector business. Many groups are, in fact, booking meetings and events in London for the first time — including a big boom in business from the technology sector. A year-over-year look at MICE market trends highlights the drivers of hotel performance and which types of business are best to target as competition in the market increases.

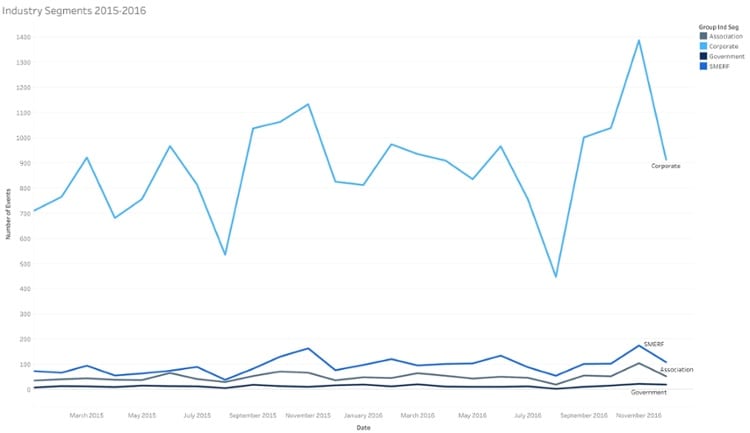

Corporate organizations account for an overwhelming majority of MICE sector business is London, sourcing 83% of actualized meetings to the market from 2015 through 2016. SMERF events account for 10% of total meetings, while associations and government meetings are merely 4.9% and 1.6% of total meetings, respectively.

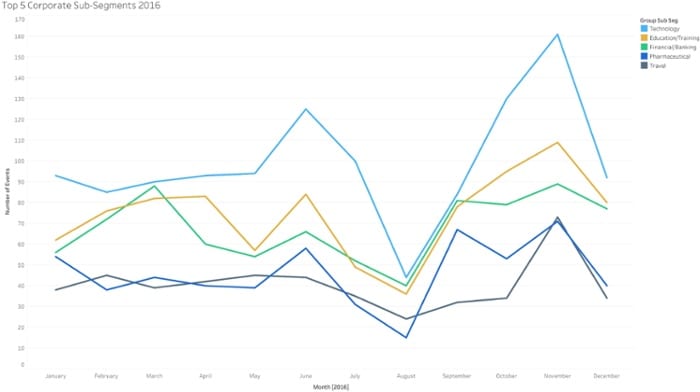

Of the corporate market segment meetings that occurred in London in 2016, the majority were for organisations from the technology sector. Total technology MICE activity has risen exponentially since May 2016. Other top-performing corporate segments include education/training, financial/banking, pharmaceutical, and travel. The sharp drop in event number for these top-performing groups in August reflects the impact of summer holiday.

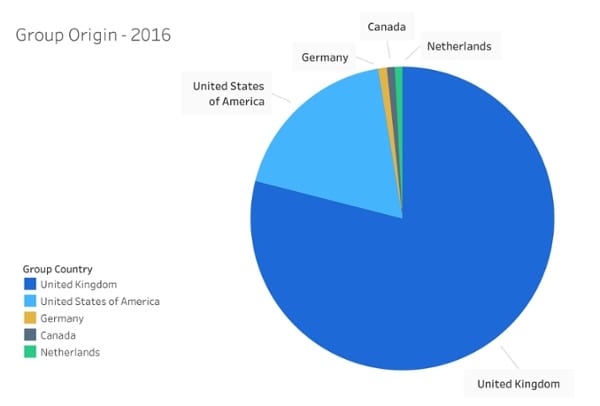

The majority of the total groups meeting in London are from the UK; however, nearly 20% of MICE market activity in 2016 was driven by organisations from the United States. Other markets feeding MICE activity into London include Germany, Canada, and the Netherlands.

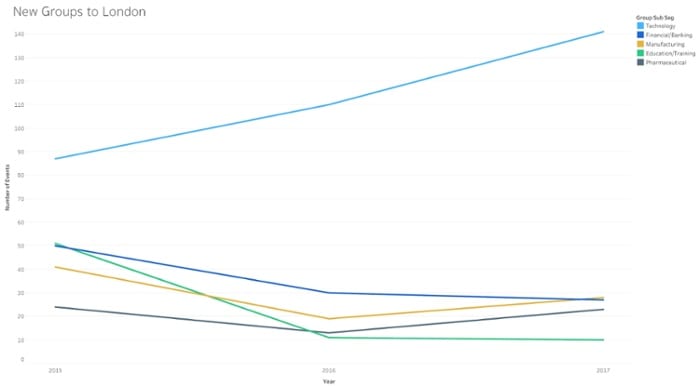

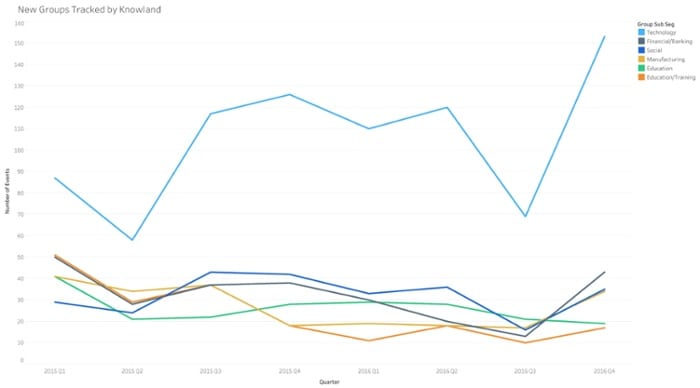

From 2015 to 2017, technology sector meetings in London have been on the rise, accounting for 62% of total new MICE activity in London. Growth trends in technology groups meeting in London for the first time jumped in Q2 2015 and the market has steadily seen new technology sector business since. This corresponds with the overall technology sector MICE activity in London for the past year.

Though overall SMERF and social MICE sector business is only 10% of London’s total group business, another notable trend in groups meeting in London for the first time is that many of them are social events. Technology meetings obviously dominate the influx of new business, but social events and financial/banking meetings are noteworthy contributors to first-time MICE market business in London.

As local competitors increase, successful hotels need to be more strategic about how they fill their rooms. Staying ahead of other properties vying for group business requires knowing where to look for unique opportunities and what groups are generating the most opportunity. Big data can lend a big hand.

![]()