Industry reporting indicates that supply growth in the US is forecasted to be 2.1% for 2019, while industry occupancy forecasts remain relatively flat. Under these conditions, developing the right strategy that includes a strong base of group business becomes more critical, ensuring that hotel operators have the leverage needed to capture the highest value transient demand later in the booking cycle, or to de-risk their position should transient demand soften. Check out of the results in this month’s Pace Navigator!

Sign up now to get the Pace Navigator in your Inbox ›

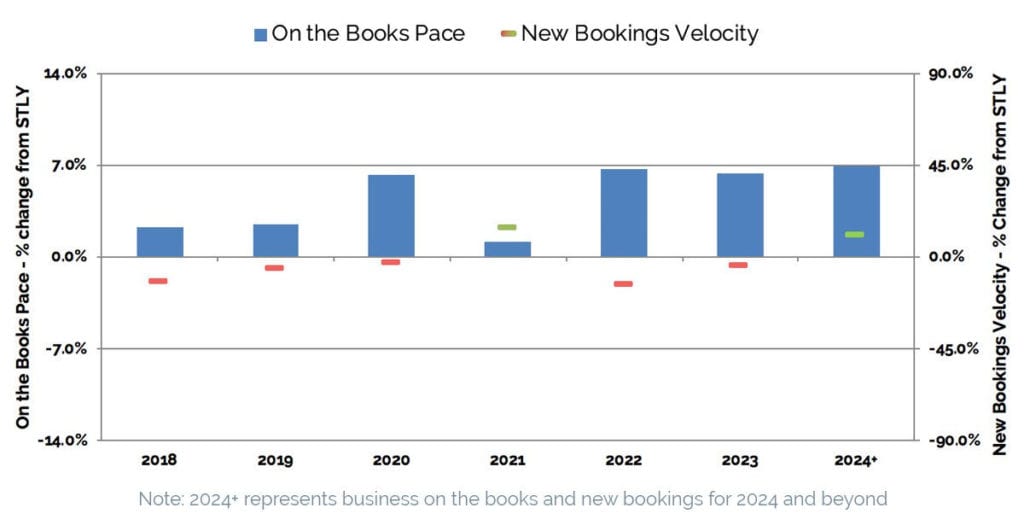

On the Books Pace & New Bookings Velocity, as of December 31, 2018

| On the Books (OTB) Pace: +4.3% |

|

This metric measures the change in definite room nights on the books, as of December 31, 2018, compared to what was on the books the same time last year (STLY), or December 31, 2017. Holding steady since last month, our data indicates 4.3% more definite rooms are on the books, compared to this time in 2017. The graph above shows the OTB Pace change versus same time last year, for each year in the future booking horizon.

| New Bookings Velocity: +0.4% |

|

This metric measures the change in room nights from newly signed bookings over the last three months, in this case October – December, compared to room nights booked over the same time last year (STLY). Across all future dates, the new bookings velocity is up 0.4% compared to the same 3-month window in 2017. The graph above shows the new bookings velocity change versus same time last year, for each year in the future booking horizon. For example, the +14.3% new bookings velocity for 2021 compares the total room nights from October – December 2018 new bookings for 2021 to the total room nights from October – December 2017 new bookings.

Our Take on This Month’s Data:

We are entering 2019 with a healthy base of group business on the books for the coming years. Group room nights on the books for North America are 4.3% ahead of where we sat this time last year. All years in the future horizon are up in booking pace over the same time last year. 2019 is starting 2.5% ahead in pace.

That said, the velocity of new bookings decelerated significantly in the fourth quarter of 2018, particularly in December. New bookings in that quarter were basically flat versus the same period last year. 2021 is the exception. New bookings velocity for that year was up 14.3%. 2021 had been lagging in on the books pace throughout the last year, only recently turning positive. So this recent surge in new bookings is welcome news.

Industry reporting indicates that supply growth in the US is forecasted to be 2.1% for 2019, the highest we’ve seen since 2009. Keep in mind this is happening while industry occupancy forecasts remain relatively flat. Under these conditions, a strong base of group business becomes more critical, ensuring that hotel operators have the leverage needed to capture the highest value transient demand later in the booking cycle, or to de-risk their position should transient demand soften.

The base of group business on the books is indeed strong heading into 2019. Recent booking velocity is less so, but not yet a concern. We look forward with anticipation to see what will unfold in the coming months. Stay tuned!

About the Pace Navigator:

Each month, Knowland collects a significant amount of data on forward-looking group demand across 60+ major North American markets. This data is provided by Convention and Visitor Bureaus (CVBs) that participate in Knowland’s TAP Report. It is unique in providing group room nights booking pace information across the entire multi-year future booking window. This data represents over 30 million annual room nights, and represents nearly 50% of the group business conducted by hotels across these markets.

Sign up now to get the Pace Navigator in your Inbox ›

![]()