Focus on Abu Dhabi & Dubai: Fueling Sales by Pivoting with Big Data

By: Kristi White, Chief Product Officer, Knowland

Recovery comes in all shapes and sizes and from all different directions. Overall, the Middle East is on a strong path to recovery, recapturing 78.4% of 2019 MICE volume in Q1 2022. However, it’s not a one size fits all process. Different markets are recovering in different ways. This makes it important for teams to be constantly on the lookout for shifts in recovery. This is made harder with smaller teams wearing multiple hats. However, data can help your teams understand what’s recovering now vs. what used to be your bread and butter business.

Throughout the pandemic, as meetings have returned to the marketplace, the industry segments returning have shifted from month to month and quarter to quarter. Hotels that thrived throughout the past two years (and yes, those hotels do exist) are the ones that were nimble and monitored the trends. They weren’t singly beholden to a list of accounts from the good old days. They didn’t wait for the business to return to them.

Instead, they read the tea leaves of the business intelligence available to them to watch what was returning (albeit) slower than they would have liked. They took advantage of transient leisure business while also keeping their fingers on the pulse of corporate business. Additionally, they pivoted regularly to shift into segments as they recovered.

Understanding Movement in the Top 10 Segments

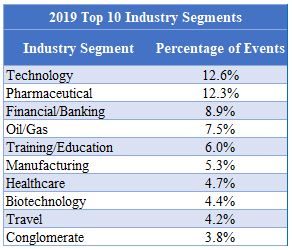

To better understand this, it is helpful to review how segmentation shifted. In 2019, the top 10 industry segments accounted for 69.7 percent of all corporate events in Abu Dhabi & Dubai. Additionally, across each quarter of the year, these segments remained in the top 10. The positions shifted across the quarters but the top 10 remained the same.

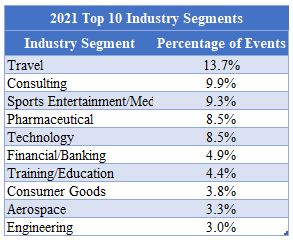

In 2021, five of the ten were replaced with different segments. Consulting, Sports Entertainment/Media, Consumer Goods, Aerospace, and Enginneering replaced Oil/Gas, Manufacturing, Healthcare, Biotechnology, and Conglomerate in the top 10.

Looking at the two charts, it might seem your teams might not have needed to change all their strategy completely. But a change was needed. New segments rose to the top and if your teams weren’t looking for them, chances are they missed some business opportunity.

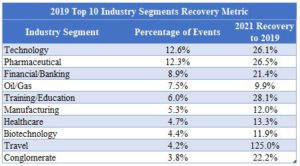

By the end of 2021, the top 10 industry segments from 2019 (with the exception of Travel) were among the lowest recovered segments. The average recovery for the top 10 was 29.6% (19% when Travel is removed). So, even though these were the movers and shakers in 2019, that wasn’t the same in the early stages of recovery. These segments lagged and hotels that continued to attempt to sell into these segments probably struggled.

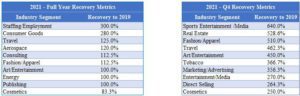

Now looking at the other end of the spectrum to see what is functionally recovering, there is a completely different perspective as well as a completely different set of accounts. The charts below show the full year 2021 recovery side by side with those same metrics for Q4 of 2021.

It’s easy to see the shift in recovery from the whole year to Q4. Again there were five different segments in the top fully recovered segments in Q4 than for the whole year. In the space of three months the sellable landscape shifted dramatically. This illustrates the importance of looking beyond what used to be and focusing on what is happening right now.

Now let’s turn the focus to 2022 to see what additional shifts have occurred. Seven of the top ten industry segments are the same as in 2019. However, there are three additional segments: Consulting, Marketing/Advertising, and Fashion/Apparel.

For most markets, this might represent dozens of companies (or more) in each of the new industry segments. However, if your teams aren’t focused on the changing trends, they will miss out on the opportunity.

Now looking at the opportunity from the recovery spectrum, the industry segments below are the most recovered to 2019 through the end of March. From Q4 of 2021, there are four new entries: Data/Research Services, Environmental Services, Consumer Goods, Transportation, and Energy. Once again, in the space of three months, the sellable landscape has shifted.

As teams reengage the sales process, it’s vital they start searching where the biggest opportunities lie. Understanding market conditions at the macro level can help focus the efforts and make sure the sales team is making the best use of its time.

Better Understanding Business Intelligence to Gain Greater Profitability

Strong business intelligence (BI) tools are a must for sales teams. It’s time to stop thinking certain tools are only for specific teams. Every BI tool has different features and each feature can be used differently within each department. However, too often, these tools are pigeon-holed as a revenue management tool, a sales tool, etc. and in the process, it is then neglected by the other teams.

Every BI tool should be used by multiple teams. Not every feature within your BI tools is meant for every member of your staff. However, you and your team should be able to walk through the features and determine which works for each team. Additionally, your vendors should be able to help you work through this process as well. Remember there will be features that work across multiple disciplines and these are the ones you really want to focus on.

Once you’ve determined which features have potential across multiple teams, your teams need to agree on how to use each one. Each team will likely have different interpretations of the features because they have different needs. It’s important to create alignment for each one:

- Create an understanding of how and why each team uses a particular feature

- Identify mutually beneficial uses for each one

- Develop a plan for use going forward

Beyond aligning their common uses, the teams should work together to understand the other features each team uses. Does revenue management gain market trend information from somewhere sales doesn’t have access? Can sales help revenue management understand account potential better with tools they have access to?

Working together to understand the flow of how each team uses their BI tools will create alignment and coordination which will help open up the sales opportunities. In other words, each team can help the other work smarter not harder.

Tearing Down the Silos to Create Greater Efficiency

The silos that existed between sales and revenue management have been greatly reduced over the past two years. However, it’s time to tear down the silos altogether. Revenue management excels at reading the tea leaves and understanding the trends. Working together with sales, they can point them in new and possibly better directions for prospecting for business entering, re-entering, or simply shifting within the market.

Sales can research those opportunities and find the accounts driving the macro trends revenue managers see. Then they can help revenue management understand the total account value so the two teams can pull together the optimal offering to capture new, re-emerging or share-shifting business. This should be the most synergistic relationship within your hotel.

In these times of tighter staffing, doing more with less, cross-functional teams are the only way your hotel can be successful. It is vital your sales team is focused on the business that exists right now, not the business they want to return (unless those are the same). Together the two teams can identify the trends as they are happening and get ahead of the competition.

About Kristi White

As a hospitality veteran by trade, with two decades of experience in the global hotel and revenue management side of the industry, Kristi has a pulse on the needs of hospitality group business. She has advised hundreds of hotels worldwide on improving their business strategy, hotel performance, and overall profitability. She is a recognized expert in hospitality and a frequent speaker at industry conferences and universities, as well as a former member of the Board of Directors for the HSMAI Revenue Management Special Interest Group.

As a hospitality veteran by trade, with two decades of experience in the global hotel and revenue management side of the industry, Kristi has a pulse on the needs of hospitality group business. She has advised hundreds of hotels worldwide on improving their business strategy, hotel performance, and overall profitability. She is a recognized expert in hospitality and a frequent speaker at industry conferences and universities, as well as a former member of the Board of Directors for the HSMAI Revenue Management Special Interest Group.

For information on Knowland data insights or solutions for the Middle East market, contact us at info@knowland.com or reach out to our local representative Erika Bucsi, Enterprise Director of Sales, EMEA & APAC at ebucsi@knowland.com.