Corporate Event Volume Exceeds 2019 Levels in Middle East

By: Kristi White, Chief Product Officer, Knowland

At the end of April, we looked at the Middle East and how it was recovering. The metric we reviewed was corporate business and its level of recovery. At that time, corporate meetings and events were recovered at 84.3 percent of 2019 levels.

In the ensuing quarter, that position has improved materially. At the end of June, corporate meetings and events have recovered to 134.8 percent of 2019 levels. This is an impressive feat and the only region of the world that was rebounded this impressively.

However, there are still a few industry segments not as fully recovered as the whole. Looking at the top 10 industry segments in 2019 provides a glimpse of this. While the region as a whole sits at 134.8 percent recovered, the top 10 segments from 2019 are a bit lower at 119.6 percent.

This recovery percent is being driven by three segments: Technology, Travel, and Consulting. These three segments are each experiencing dramatic growth relative to 2019 and they also now represent a significantly larger piece of the overall business for the region. In 2019, these segments represented 21.9 percent of corporate events and meetings in the region. In 2022, they represent 31.1 percent.

This is a sizable shift and not one being seen as dramatically elsewhere in the world. With the exception of Travel, the other two segments are lagging across the rest of the world.

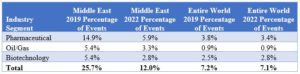

On the opposite side of this, there are three segments causing the shift down for the top 10. Pharmaceutical, Oil/Gas, and Biotechnology. These three combined to represent 31.1 percent of the corporate events and meetings in 2019. In 2022, they represent a paltry 12.0 percent.

Here is where the region differs from the rest of the world. While the three segments are roughly recovered at the same levels elsewhere in the world. They have maintained their percentage of overall corporate events and meetings. In 2019, these segments represented 7.2 percent of total corporate business. In 2022, they represented 7.1 percent.

While the region is ahead of the remainder of the world, these three segments are performing outside of the norm. While this might be somewhat anomalous and just a metric of recovery. It is something to keep an eye on to adjust as necessary in case this isn’t a recovery shift but a long-term change in the mix of business for the region.

Shifting gears, to understand which segments are the Top 10 in 2022. These segments are mostly the same as they were in 2019. There is one new segment (Marketing/Advertising). These ten segments are recovered at 127.9 percent of 2019 levels. This is better than the top 10 segments from 2019 but not as strong as the overall numbers.

Two of the three segments discussed earlier (Pharmaceutical and Oil/Gas) are on this list as well. The third, Biotechnology, has dropped out of the top 10 (it is now in the twelfth spot).

Now, let’s look at the recovery metrics from the perspective of those segments most recovered. None of these segments are in the Top 10 which means they reflect new opportunity for hotels. In 2022, they represent 16.0 percent of overall corporate meetings compared to 2019 where they represented only 5.8 percent.

Hotels prospecting within these accounts can make inroads into developing relationships with companies in these segments early. These segments are helping to drive the strong recovery in the region. While this might possibly be temporary and these segments will return to 2019 levels, these are important now.

Overall, the Middle East is ahead of the rest of the world by a significant amount. However, there are still a few segments lagging that might be concerning if these are the segments a hotel is highly dependent on. Being agile and looking into other segments will help fill those voids until those three segments (Pharmaceutical, Oil/Gas, and Biotechnology) return to normal is crucial for a hotel.

Recovery is upon the region. And, it’s coming from a much broader collection of industry segments than we historically see. Sales teams need to broaden their prospecting efforts to ensure they are capturing as much of the recovering business they can. Sitting back and relying on the same old, same old will likely delay an individual hotel’s recovery path.

This is a moment in time where operators hope rising tides are lifting all boats. However, hope is not a business strategy. Savvy hotels should be rowing out to meet the tide so they get ahead of the curve and stay ahead of the curve.

About Kristi White

As a hospitality veteran by trade, with two decades of experience in the global hotel and revenue management side of the industry, Kristi has a pulse on the needs of hospitality group business. She has advised hundreds of hotels worldwide on improving their business strategy, hotel performance, and overall profitability. She is a recognized expert in hospitality and a frequent speaker at industry conferences and universities, as well as a former member of the Board of Directors for the HSMAI Revenue Management Special Interest Group.

As a hospitality veteran by trade, with two decades of experience in the global hotel and revenue management side of the industry, Kristi has a pulse on the needs of hospitality group business. She has advised hundreds of hotels worldwide on improving their business strategy, hotel performance, and overall profitability. She is a recognized expert in hospitality and a frequent speaker at industry conferences and universities, as well as a former member of the Board of Directors for the HSMAI Revenue Management Special Interest Group.

For information on Knowland data insights or solutions for the Middle East market, contact us at info@knowland.com or reach out to our local representative Erika Bucsi, Enterprise Director of Sales, EMEA & APAC at ebucsi@knowland.com.