Event Volume Fully Recovered to Pre-Pandemic Levels in Middle East

By: Kristi White, Chief Product Officer, Knowland

Each quarter, we looked at the Middle East and how it was recovering. At the end of 2022, we revisit these metrics and compare to Asia Pacific and the United States. For the full year, the Middle East is recovered at 154.2% compared to 2019. As a contrast, Asia Pacific is recovered at 68.2% and the United States at 77.8%.

Looking at corporate events only, the numbers change slightly but are still strong. The Middle East is at 141.1% recovery, APAC is at 68.5% and the United States at 74.8%.

The Middle East continues to be the only region where recovery is ahead of 2019 metrics for the full year. However, APAC and the United States did have strong performances in Q4. APAC achieved greater than 100% recovery in both November and December. The U.S. achieved greater than 100% recovery overall in November and December. Additionally, it also achieved 100% recovery in November. There was a minor dip in December for corporate events, but overall events were ahead of 2019 for December.

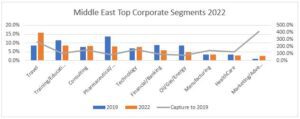

Diving into the numbers, there are pockets where the recovery is not quite as robust. Looking at the top 10 industry segments in 2019 provides a clearer image of this. While the region, as a whole, sits at 141.6 percent recovered, the top 10 segments from 2019 are a bit lower at 125.6 percent.

Seven of the top 10 segments in 2022 were fully recovered to 2019. Those segments (Travel, Training/Education, Consulting, Technology, Manufacturing, Healthcare, and Marketing/Advertising) are recovered at 164.4 percent vs. 2019. Additionally, Travel now makes up 15.9 percent of overall corporate business compared to 8.5 percent in 2019.

For the remaining segments (Pharmaceutical/Biotechnology, Financial/Banking, and Oil/Gas/Energy), the recovery metric is at 84.5 percent, decidedly lower than the region and the other segments. Additionally, in 2019, these segments comprised 31.1 percent of overall corporate business and now they only represent 18.6 percent.

As a final note on the top 10 segments from 2022, their share of the overall mix has shifted dramatically. In 2019, these ten segments represented 73.9% of overall corporate business for the region. In 2022, they represent 68.5%. Most of this is likely being driven by the laggard recovery of the three segments (Pharmaceutical/Biotechnology, Financial/Banking, and Oil/Gas/Energy). However, these segments are lagging elsewhere in the world. So, this might be the new normal for these segments and something hotels need to prepare to deal with going forward.

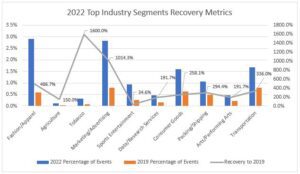

Now, let’s look at the recovery metrics from the perspective of those segments most recovered. Three of the (Travel, Consulting, and Healthcare) segments is in the Top 10 (for 2022) which means they reflect new opportunity for hotels. For 2022, they represent 28.7 percent of overall corporate meetings compared to 2019 where they represented only 14.2 percent.

Developing relationships with companies in these segments early will help create long-term, valuable connections to benefit your hotel today and into the future. These segments are driving the strong recovery in the region. This is even more important as some of the top segments from 2019 might never fully recover.

As strong as the recovery is, there are still segments struggling to recover. Savvy sales teams need to work with companies in those segments to understand if this sluggishness is temporary or permanent. Knowing and understanding this now will help you build better plans for the future.

Now, let’s look at the recovery metrics from the perspective of those segments most recovered. Only one of these (Fashion/Apparel) segments is in the Top 10 (for 2022) which means they reflect new opportunity for hotels. Year to date, they represent 12.4 percent of overall corporate meetings compared to 2019 where they represented only 4.0 percent.

Developing relationships with companies in these segments early will help create long-term, valuable connections to benefit your hotel today and into the future. These segments are driving the strong recovery in the region. This is even more important as some of the top segments from 2019 might never fully recover.

The Middle East Compared to the U.S. and APAC

The Middle East continues to recover ahead of other regions of the world in the corporate segment. Year to date, the United States is recovered at 66.5 percent (although in Q3, they are recovered at 86.3 percent). APAC is recovered at 64.2 percent (86.4 percent in Q3). The 132.6 percent recovery in the Middle East places it well ahead of the remainder of the world and positions the region for an even stronger 2023.

As strong as the recovery is, there are still segments struggling to recover. Savvy sales teams need to work with companies in those segments to understand if this sluggishness is temporary or permanent. Knowing and understanding this now will help hoteliers build better plans for the future.

About the Author

Kristi White | Knowland Chief Product Officer

As a hospitality veteran by trade, with two decades of experience in the global hotel and revenue management side of the industry, Kristi has a pulse on the needs of hospitality group business. She has advised hundreds of hotels worldwide on improving their business strategy, hotel performance, and overall profitability. She is a recognized expert in hospitality and a frequent speaker at industry conferences and universities, as well as a former member of the Board of Directors for the HSMAI Revenue Management Special Interest Group.

As a hospitality veteran by trade, with two decades of experience in the global hotel and revenue management side of the industry, Kristi has a pulse on the needs of hospitality group business. She has advised hundreds of hotels worldwide on improving their business strategy, hotel performance, and overall profitability. She is a recognized expert in hospitality and a frequent speaker at industry conferences and universities, as well as a former member of the Board of Directors for the HSMAI Revenue Management Special Interest Group.

For information on Knowland data insights or solutions for the Middle East market, contact us at info@knowland.com or reach out to our local representative Erika Bucsi, Enterprise Director of Sales, EMEA & APAC at ebucsi@knowland.com.